Oil And Gas Royalty Interest Valuations

Recently we have been active in the valuation of oil and gas royalties for estate tax purposes and have come to the conclusion that the predominant methods used are determined by Petroleum Engineers often using a reserve appraisal method (see information published by the Society of Petroleum Evaluation Engineers) instead of an income method determined from general business valuation theory.

The discount rate used (often 10%) happens to be the S.E.C. safe harbor rate, not a discount rate supported by any recognized build-up WACC method or a market derived method. In addition, the analysts often apply after tax discount rates to before tax indexes resulting in a mismatch of discount rates and cash flow.

Although discount rates determined from market sales are rarely used, they are commonplace in the ad valorem taxing industry. See the latest survey, which appears below:

| Summary of Findings From Annual Sales Analysis, Market Survey, and the 2007 Property Value Study. | |||||

|---|---|---|---|---|---|

| Study Author | Discount Rate | Standard Deviation | Discount Rate Range | Data Points | |

| To | From | ||||

| Richard J. Miller & Associates * | 22.10 | 5.90 | 16.20 | 28.00 | 78 |

| Society of Petroleum Evaluation Engineers ** | 14.20 | 4.42 | 9.78 | 18.62 | 70 |

| Texas Comptroller of Public Accounts / Property Tax Division *** | 18.82 | 2.61 | 16.21 | 21.43 | 9806 |

| Average | 18.37 | 4.31 | 14.06 | 22.68 | |

| * Discount rate based on 78 PDP transactions 1990 – 2005: Analysis of Oil and Gas Transactions and Sales, January 11, 2006 | |||||

| ** Discount rate based on 70 survey responses: Survey of Economic Parameters Used in Property Evaluation, June 2008 | |||||

| *** Discount rate based on the appraisal of 9,806 properties (less ad valorem taxes): 2007 Property Value Study | |||||

Source: Texas Comptroller of Public Accounts: Property Tax Division

Based upon the reconciliation of data from the sales analysis market survey, the Texas Property Tax Division concludes that a before tax discount rate range of 17.25% to 22.68% is generally suitable for the appraisal of oil and gas properties, unless property specific risk requires use of a discount rate outside this range. This approximates the small company average return of 17.4%, as reported by Partnership Profiles in their oil and gas treatise.

The use of the financial information is an acceptable practice for the estate tax valuation. Texas Tax Code §23.01(a) requires “market value” county appraisals of taxable property. Texas Tax Code §1.04(7) defines “market value” consistent with the definition of “fair market value” in Treas. Reg. §25.2512-1. As such, it is appropriate to use this methodology to arrive at the fair market value for oil and gas royalties.

Although oil and gas royalties are considered real estate, we are beginning to see the emergence of both public and non-public entities, which market undivided oil and gas royalty interests to investors. In this case, the subject interest is also a security interest, subject to a lack of market discount, which also does not appear in industry practice. The rules of thumb for purchases currently used in the industry are as follows:

- 36 to 48 times current income, and/or

- 36 to 48 times the last three years monthly income

A comparison to the undivided oil and gas royalty funds using the Market Approach to Value is another alternative, as Section 2031(b) of the Internal Revenue Code states that in valuing unlisted securities, the value of stock or securities of companies engaged in the same or a similar line of business, which are listed on an exchange, should be taken into consideration.

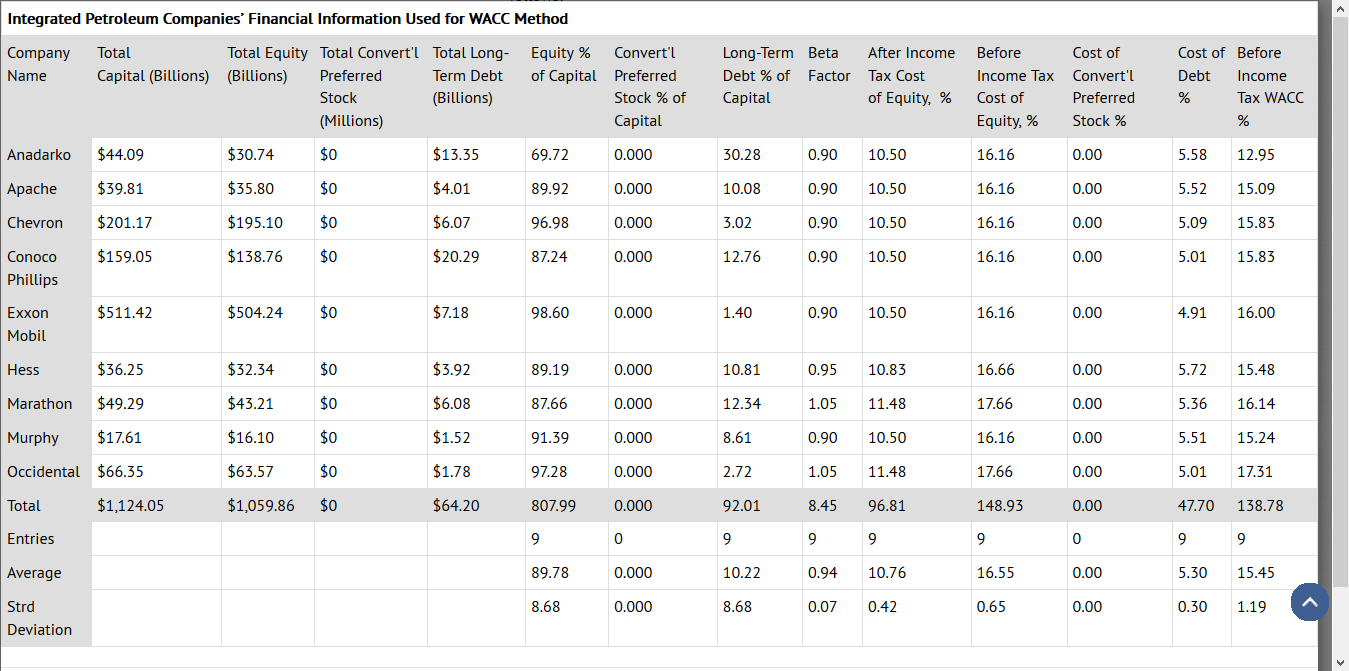

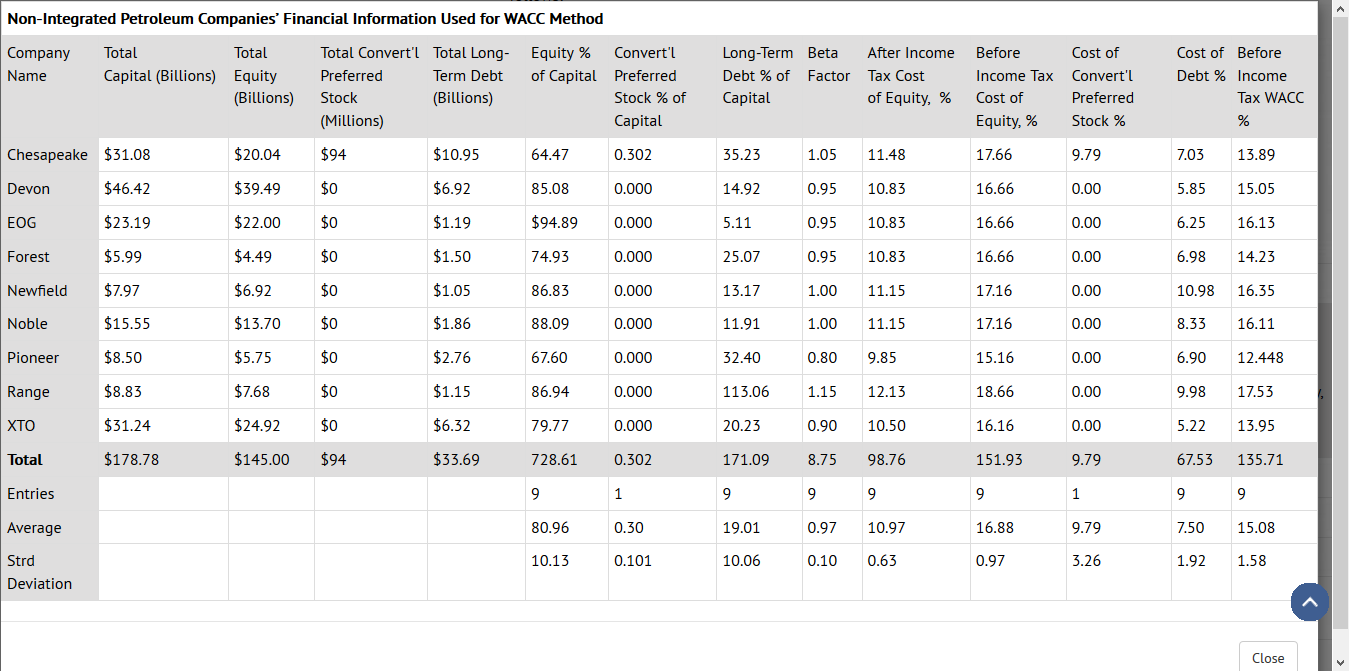

Current information on the WACC method based for both integrated and non-integrated public oil companies follows:

Source: Texas Comptroller of Public Accounts: Property Tax Division

Remember, these rates apply to publicly held companies, most likely not your subject interest.

The recent changes by the S.E.C., as part of the modernization of oil and gas reporting, will most likely again affect the valuation process. Keep in mind that the S.E.C. is concerned with valuation of reserves, as opposed to determining value. The 10% safe harbor discount rate, which is used to value publicly held company reserves, does not approximate market risk and is sometimes less than WACC.

Although the S.E.C. has mandated that oil and gas prices are to be determined based on the prior 12-month average, we believe it is more appropriate to use current prices and perhaps probabilistic methods (Monte Carlo Simulation) to determine value for the royalty interests.

Some highlights of the proposed S.E.C. rule changes include:

- Adopting extensive, revised, and new definitions relating to reserves and reserve categories, relying heavily on current industry standards, including the Society of Petroleum Engineers’ Petroleum Resource Management System (PRMS). The revisions are intended to permit the use of new technologies to determine proved reserves, if those technologies have been demonstrated empirically to lead to reliable conclusions about reserves volumes. The revisions also classify oil sands and bitumen production as oil and gas, rather than mining reserves. The revisions may also permit broader recognition of proved undeveloped reserves in certain formations.

- Replacing, for reserve reporting purposes, end-of-the-year oil and gas reserve pricing with an historical average of end-of-the-month pricing for the past 12 months. The revision is not proposed for oil and gas accounting measurements, which would retain end-of-period pricing for reserve quantities and values used in determining depletion and impairment measurements.

- Permitting optional disclosure of probable and possible reserve estimates, which are currently not permitted in S.E.C. filings, in most instances, but often widely distributed by companies in investor presentations and press releases. Requiring background information on qualifications of persons with primary responsibility for providing reserve estimates and audit reports, including in-house persons.

- Requiring minimum disclosures for third party reserve review and audit reports disclosed in S.E.C. filings.

- Requiring the filing of summary reserve reports and audit reports, if such reports are prepared by third parties containing certain required disclosures.

- Requiring more detailed discussion and analysis by management of exploratory and development operational results, including comment on known trends and uncertainties, and including in tabular form the results of conversion of proved undeveloped-to-producing reserves over the reporting period.

- Providing a framework for optional disclosure of sensitivity analyses showing the impact of changes in pricing, costs, or other variables on reserves.

- Requiring greater detail in tabular form of reserves by category and oil and gas activity disclosure by geographic regions and significant fields.

Conclusion

We agree that the predominant method for the valuation of oil and gas royalties is the Income Approach to Value.

It is our opinion that the blind application of a 10% discount rate (S.E.C. mandated rate for public companies) will overvalue the subject interest, as current acceptable before tax discount rates imply a 17-23% range, much higher than what is prevalent in industry practice.

We have the ability to work in 40 states of the continental U.S. including Alaska.

For our Article on Oil & Gas Valuation update, click here.